The Trump family’s cryptocurrency ventures are hemorrhaging money in a stunning collapse playing out in real-time.

Multiple memecoins and cryptocurrencies founded or promoted by President Donald Trump and his sons are now losing value at a faster rate than bitcoin, which has plunged around 25 percent from its October peak of roughly $126,000 during a particularly turbulent period for the world’s most valuable digital asset.

That includes World Liberty Financial, the Trump family’s flagship crypto venture, whose token has fallen more than 30 percent from its September peak. Shares of Alt5 Sigma—previously linked to World Liberty Financial—have also cratered by roughly 75 percent as the company faces potential financial reporting violations and other legal issues, Bloomberg News reported.

Memecoins named after Trump and First Lady Melania Trump have similarly tanked, dropping 90 percent and 99 percent, respectively, from their record highs in January as the family returned to the White House.

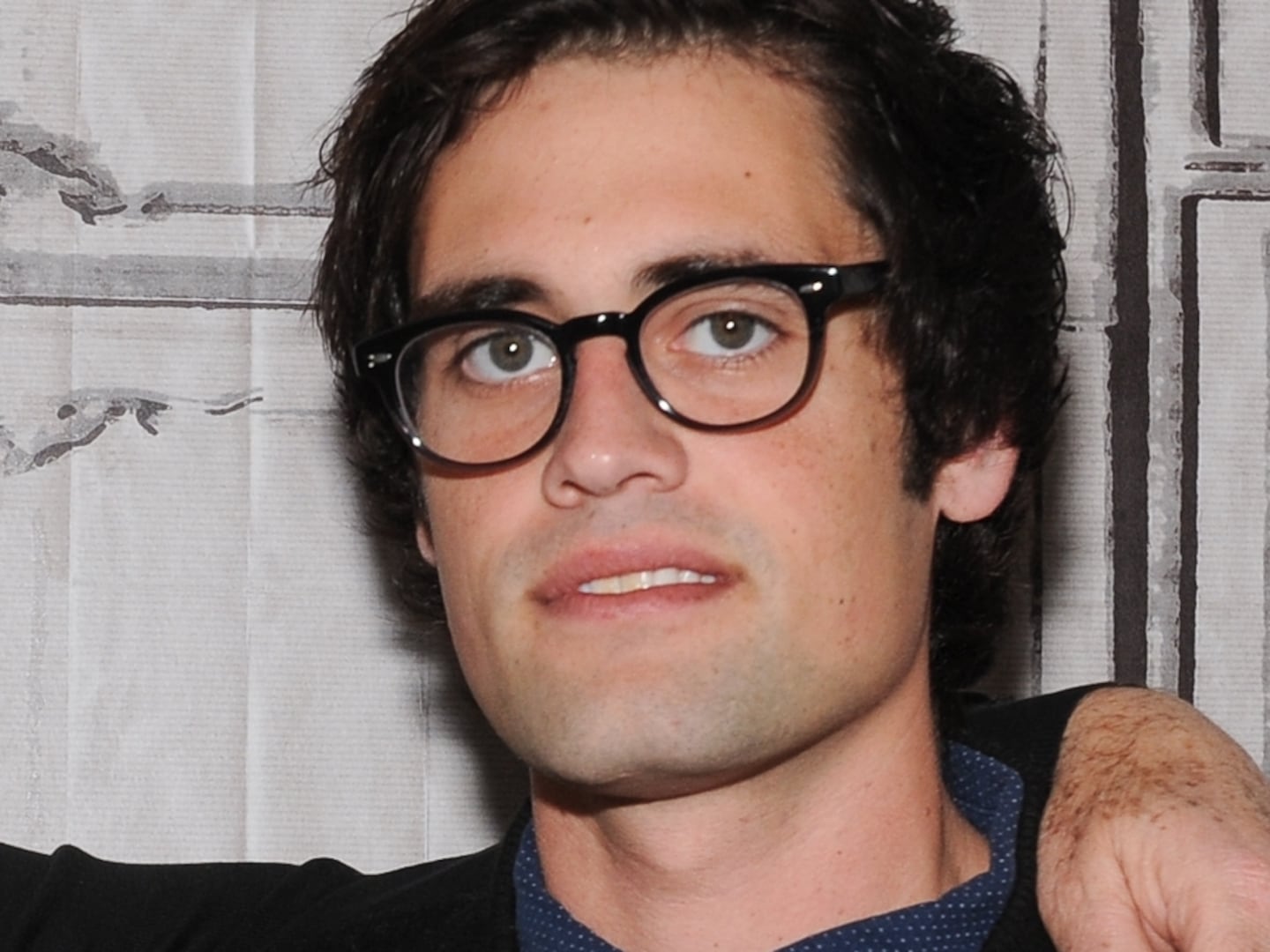

Shares in American Bitcoin Corp., Eric Trump’s crypto-mining business, also nosedived after losing more than 30 percent of its value in less than a minute, ending Tuesday with a 39 percent drop. The plunge occurred after American Bitcoin freed up restricted shares for public trading, though Bloomberg noted the stock rebounded slightly with an 8.7-percent rise in premarket trading on Wednesday morning.

A defiant Eric Trump said he will not be dumping his shares after Tuesday’s freefall for American Bitcoin.

“I’m holding all my ABTC shares—I’m 100% committed to leading the industry," he posted on X.

Elsewhere, shares in Trump Media & Technology Group (TMTG)—the media company that owns Truth Social and is majority-owned by Trump—are currently trading around $11, down from $42 in early January after the company made large investments in bitcoin.

“The Trump presidency has been a double-edged sword for legitimacy,” Hilary Allen, a law professor at American University’s Washington College of Law, told Bloomberg. “Trump started launching his own crypto projects, many of which lost value very quickly. If the goal was to achieve legitimacy through the Trump family, that’s not helped.”

While still enormously lucrative, the Trump family’s plummeting digital fortune mirrors the broader collapse across cryptocurrency markets. Last month, Bloomberg estimated that market turmoil had wiped roughly $1 billion from the Trump family’s net worth—from $7.7 billion in early September to $6.7 billion in late November.

Eric Trump, the president’s second-oldest son and executive vice president of the Trump Organization, has downplayed the massive crypto losses and insists the downturn represents a “great buying opportunity” for investors.

“People who buy dips and embrace volatility will be the ultimate winners. I have never been more bullish on the future of cryptocurrency and the modernization of the financial system,” he told Bloomberg in November.